Sharing Corner:

Tax season is here again! This year, my dear homeowner friends, remember to declare the expenses for your newly purchased home.

Thuy updates you with the latest tax changes:

The standard deduction for the 2023 tax season has increased slightly: $27,700 for Married and $13,850 for Single.

Here are the details:

- $27,700 – Married Filing Jointly or Qualifying Surviving Spouse (2022 Tax: $25,900 – increase of $1,800)

- $20,800 – Head of Household (2022 Tax: $19,400 – increase of $1,400)

- $13,850 – Single or Married Filing Separately (2022 Tax: $12,950 – increase of $900)

There are additional deductions for those over 65 years old or who are blind:

- $1,850 for Single or Head of Household (2022 Tax: $1,750 – increase of $100)

- $1,500 for married taxpayers or Qualifying Surviving Spouse (2022 Tax: $1,400 – increase of $100)

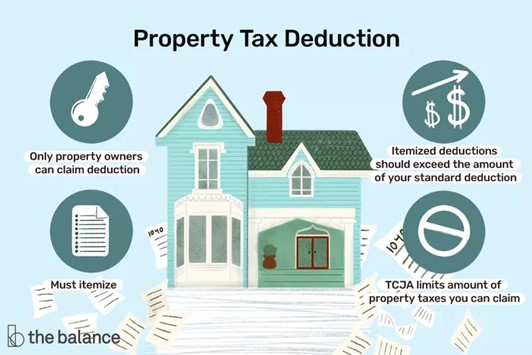

🔥 If you are claiming for a home is PRINCIPAL RESIDENCE, you can use the Itemized Deduction. You must choose between the Standard Deduction or the Itemized Deduction, whichever is higher, because you can deduct expenses before paying taxes.

The Itemized Deduction for your home includes:

- Property Tax (maximum deductible is $10k. If you pay more than $10k in property tax per year, you can only deduct up to $10k).

- Mortgage Interest (If you have a loan, the maximum deductible is $750k. Generally, you can deduct the maximum. For example, if you pay $5,000 in interest per month x 12 months, you can deduct $60k. Just ensure you have enough income to deduct it all).

If these two together exceed the $27,700 standard deduction, make sure to claim them. If your house is fully paid off and you can only deduct $10k in property tax, check if you have other expenses such as:

- Medical & Dental Expenses

- Taxes you paid, maximum $10k

- Gifts to charity

- Casualty & Theft Losses

- Healthcare

If the total exceeds the Standard Deduction, choose the Itemized Deduction.

🔥 If you are claiming for a RENTAL PROPERTY, treat it as income and list all expenses you pay for the property to determine your net income and tax liability. Expenses include:

- Property Tax

- Mortgage Interest

- Home Insurance (including fire and earthquake insurance)

- HOA fees for townhouses and condos

- Depreciation (spread over 27.5 years). Note: If you deduct this, you must add it back when you sell the house.

- Utilities, you can claim if you pay them (if the tenant pays, you cannot deduct them).

🌟 If you can’t remember all this, just call Thuy! Thuy will help you. Love you always 🥰